Aditya Birla Sun Life Insurance has brought a new plan Aditya Birla Sun Life child future assured plan ( ABSLI child Assure Plan) offering life cover to the parent, payout for important milestone of child, and of course tax benefit for you.

As a parent, your child is always at the center of universe and you want to ensure nothing but the best at every milestone.

However the increasing cost of inflation education and other uncertainties may upset your dreams for your child.

Aditya Birla Sun Life insurance company has brought a child future assured plan for assuring that your child’s future is secured.

Introduction Lines are taken from ABSL.

Table of Contents

What Plan does for you

- This plan basically covers your child education need milestone

- You may also get covered for marriage milestone benefit or education and marriage benefit

- The parents/life is assured in this plan.

- So you can say that this plan offers a payout for education, marriage or education and marriage milestone of your child.

Basic Eligibility conditions

What Benefit Options available

There are three different benefit options are available. You can choose any option as per your choice.

Education Milestone Benefit

If you want the payout only for education then you can opt for Education Milestone Benefit.

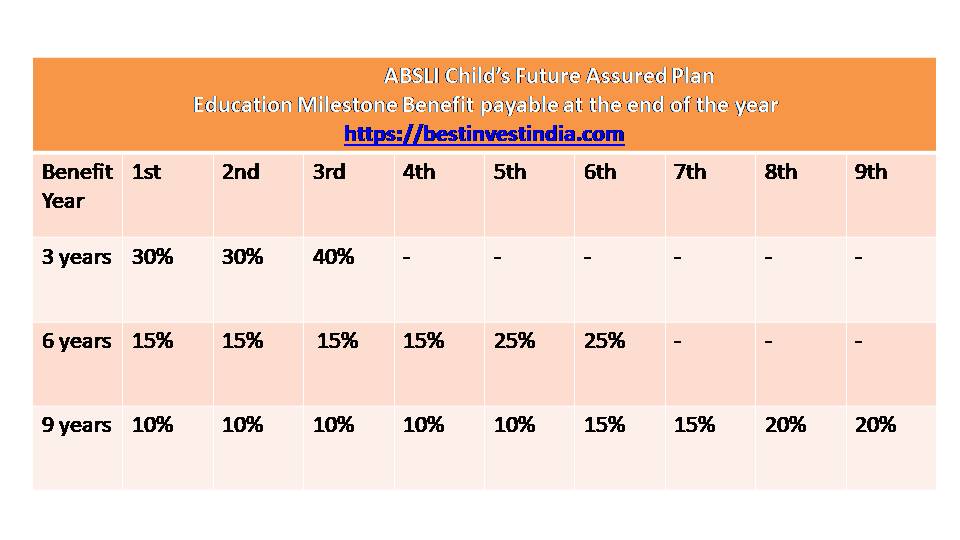

In this milestone assured benefit is paid annually at the end of each year. You can choose from the benefit of 3 year/ 6 year/ 9 year.

You get payout in 3/6/9 years as opted by you.

In 3 year option, you will get a certain percentage of sum assured for 3 years.

Similarly, in 6 years you will get a certain percentage of sum assured for 6 years and the same is for 9 years.

Please refer to the table for the payout option.

Marriage milestone benefit

If you do not want education milestone benefit then you can choose for the child marriage purpose only.

This option will give you a guaranteed lump sum payout at the end of the policy term( as to chosen by you ) when your child age is between 24 to 32 years.

Education and Marriage milestone benefit

If you want then you can choose both options together that is an education milestone benefit and marriage milestone benefit.

The education milestone payment will be the same as stated above on their respective due date and the marriage milestone benefit will be paid at the end of the policy term.

# Please note here you have the flexibility to defer any of the assured benefit payment for 1 to 3 years.

Deferment of Benefits

You have the flexibility to defer any of the Assured Benefit payment by 1, 2, or 3 years.

This will enhance the deferred pay-out by 6.0% p.a. (or such other rate as determined by ABSLI subject to prior approval from IRDAI from time to time).

Once the Deferral of the pay-out is deferred, you cannot change it thereaſter.

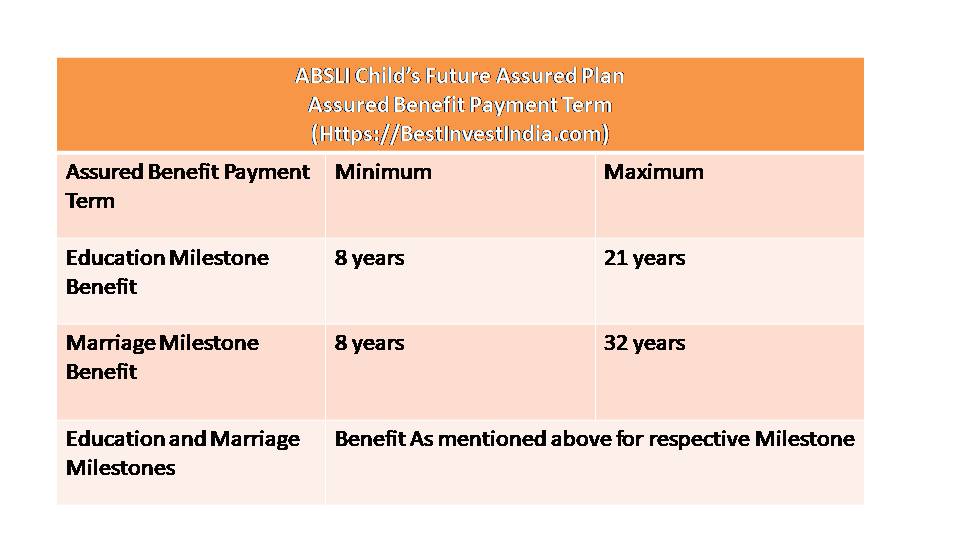

Premium Paying term for Assured Benefit Payment term

Maturity Benefit

The Maturity Benefit shall be the amount of Assured Benefit payable at the end of the Policy Term( as described in the education milestone payment table.

Loyalty Additions

20% loyalty addition ( of sum assured) will be added with each assured benefit to you, provided you have paid all due premiums.

Death Claim

In case of unfortunate event with the life assured

The nominee will receive the death Claim as below:

- Assured Benefits/payout as per the option chosen by you shall be paid on their respective due dates; plus

- Any excess amount of Sum Assured on Death over the discounted value of the Assured Benefits payable in future will be paid immediately as lump-sum

- All future installment premiums shall be waived off. The nominee does not have to give any premium thereafter.

or

Alternatively, Nominee can also opt for immediate payment of death benefit.

In this case, higher of Sum Assured on Death or discounted value of all future Assured Benefits, discounted @ 8% per annum, will be paid in a lump sum and the policy will be terminated.

Enhanced Cover

If you wish to increase your life cover, then you can do so by paying an extra premium. You can increase cover by 50%/100%/200% of your basic sum assured.

If you opt Enhanced Insurance Cover you have to pay additional money for it.

In case of death of the life insured during the policy term,Enhanced Sum Assured on will be paid immediately to the nominee. The Nominee will have the option to choose one of the following

- Lump-sum payment Or

- Staggered payment with fixed annual or monthly income.

- In this option the Enhanced Insurance cover will be paid as follows: a) One-time payout of 20% of Enhanced Insurance Cover at the time of claim settlement plus; b) The remaining 80% of the Enhanced Insurance Cover is paid as an annual or monthly income in arrears over the chosen period of 5, 10, 15 years as shown in the table given below:

Returns from the policy

Entry Age : 35 years Annualized Premium* : `35,775 (excl. tax)

Gender: Male Premium Paying Term : 8 years

Policy Term: 20 years Payment Frequency: Yearly

Pay-out Period : 3 years Assured Pay-out Option : Education Milestone

Sum Assured : `5,00,000

| ABSLI Child Future Assured Plan | |

| Years | Premium Payments/Receivables |

| 0 | -35775 |

| 1 | -35775 |

| 2 | -35775 |

| 3 | -35775 |

| 4 | -35775 |

| 5 | -35775 |

| 6 | -35775 |

| 7 | -35775 |

| 8 | 0 |

| 9 | 0 |

| 10 | 0 |

| 11 | 0 |

| 12 | 0 |

| 13 | 0 |

| 14 | 0 |

| 15 | 0 |

| 16 | 0 |

| 17 | 180000 |

| 18 | 180000 |

| 19 | 240000 |

| IRR | 5.16% |

Education & Marriage Milestone Male| 35 year | Policy Term 29 years | PPT 10 year | Premium 1 lac annual (excluding tax) | Sum Assured-18,65,846 | payout option-9 Year

| Years | Premium Payments/Receivables |

| 0 | -100000 |

| 1 | -100000 |

| 2 | -100000 |

| 3 | -100000 |

| 4 | -100000 |

| 5 | -100000 |

| 6 | -100000 |

| 7 | -100000 |

| 8 | -100000 |

| 9 | -100000 |

| 10 | 0 |

| 11 | 0 |

| 12 | 0 |

| 13 | 0 |

| 14 | 111000 |

| 15 | 111000 |

| 16 | 111000 |

| 17 | 111000 |

| 18 | 111000 |

| 19 | 167000 |

| 20 | 167000 |

| 21 | 223000 |

| 22 | 223000 |

| 23 | 0 |

| 24 | 0 |

| 25 | 0 |

| 26 | 0 |

| 27 | 0 |

| 28 | 1119000 |

| IRR | 5.11% |

As you can see below returns are quite low. The premium and other figures are taken from ABSL website

Conclusion

This policy offers a triple advantage as other policies offer. You get EEE benefit i.e. you get deduction U/S 80C for premium payment, The interest part is exempt from tax and maturity will be tax-free in your hands. Moreover, in case of any unfortunate event, the regular payout will not stop. It will be paid as defined at the beginning of the policy.

Your future premium will be waived off and the option of lump sum payout is also available.

If we talk about the drawback, the return is comparatively lower as compared to other investment products.

However, this product is suitable for people who are in a high tax bracket owing to their higher income tax slab rate if you are comfortable with long lock-in time and low returns.