ICICI Prudential has launched a new facility called ICICI Prudential Booster SIP ( Systematic Investment Plan). Booster SIP is basically a combination of SIP and STP wherein you start a SIP in a source scheme and a variable amount is shifted to target scheme, based on Equity Valuation index( EVI).

Before jumping into how Booster SIP works, let’s first understand the difference in SIP and STP.

Table of Contents

What is Mutual Fund SIP?

The systematic investment plan is a way to invest in mutual funds where you deposit money each month through auto-debit facility. You can understand it like an RD in bank with better returns.

Basically, it is a monthly investment arrangement.

What is STP?

STP stands for Systematic Transfer Plan. Here in STP, you transfer your money in small chunks to a targeted mutual fund scheme.

What is ICICI Prudential Booster SIP?

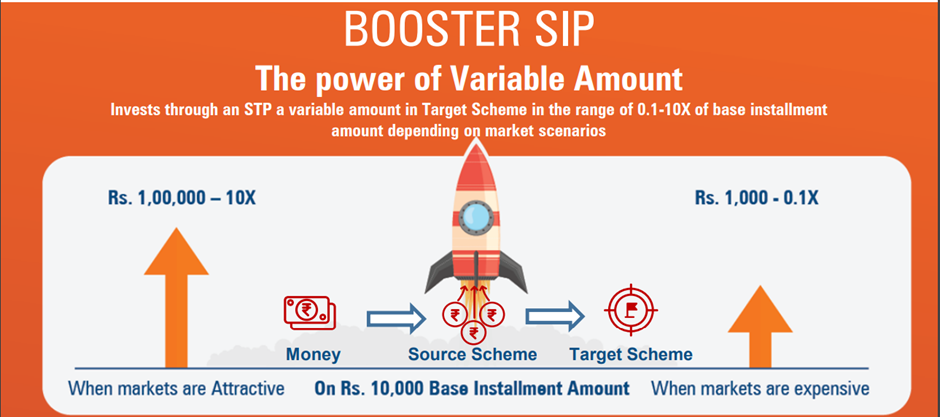

ICICI Prudential Booster Systematic Investment Plan (“Booster SIP”) is a facility wherein the customer starts a normal SIP (with a fixed amount and on fixed date) in a source scheme (Debt scheme).

Now, this SIP amount is transferred to the target scheme (equity or hybrid) on the very same date. But, here is a catch, the shifted amount may vary from 0.1X to 10X of your original SIP amount based on index.

How is Booster SIP different from a Normal SIP?

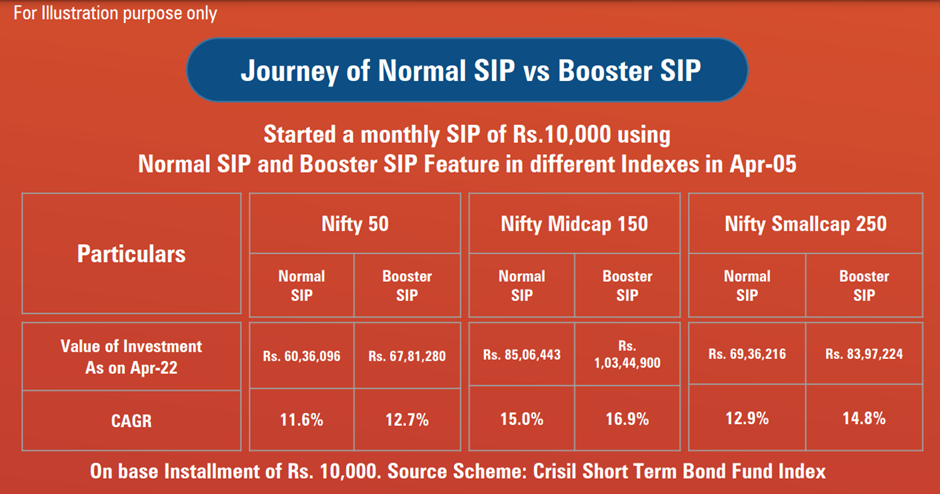

Under Normal SIP a fixed amount is invested in a target scheme whereas under Booster SIP , a fixed amount is invested in the source scheme and a variable ( different – higher or lower) amount is transferred to the Target Scheme, depending on Equity Valuation Index.

For example if your SIP amount is 10000 than the transferred amount may vary from

10000*0.1X =Rs 1000

10000*10X = Rs.100000

What is the minimum Booster SIP amount?

The minimum Booster SIP amount is Rs.1000. Otherwise you can choose your own desired amount as SIP.

How is the multiplier decided?

The multiplier is decided based on the Equity Valuation Index. EVI is the Equity Valuation Index which is a proprietary model of ICICI Prudential AMC Ltd. (Henceforth referred to as EVI)

What is EVI?

EVI is the Equity Valuation Index which is a proprietary model of ICICI Prudential AMC Ltd. The EVI is derived by assigning equal weights to Price to Earnings (PE), Price to book (PB), Government Securities*PE and Market Cap to Gross Domestic Product (GDP)

What are the frequencies available under Booster SIP?

Booster SIP offers facility at weekly & monthly intervals.

What will be the frequency of the STP transaction?

The Frequency of the STP shall be same as per the Booster SIP registration

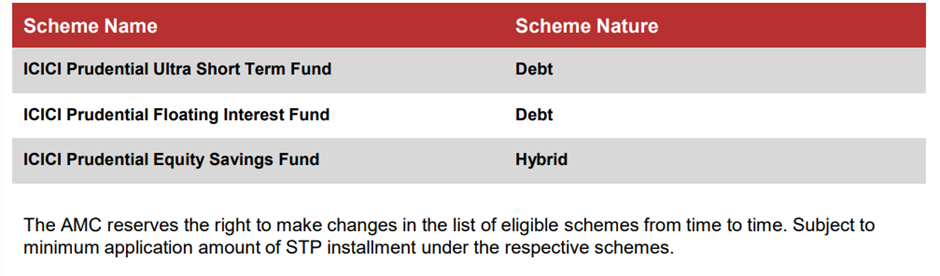

What are the available source scheme?

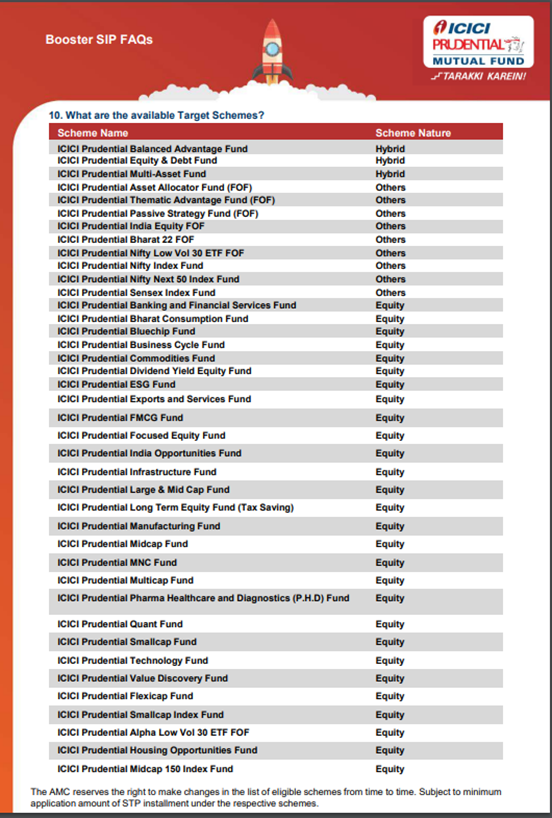

What are the available target schemes?

How will the transfer take place?

Illustration: Calculation of amount of Booster SIP:

Source : Fund A

Target : Fund B

Date – 28th date

Frequency – Monthly

SIP Amount- Rs. 10,000/-

Base Instalment Amount- Rs. 10,000/-

Number of Instalments – Default i.e 2099

First SIP Date in Source Fund – 28th July 20X1

Transfer Initiated from 28-Aug-20X1 a

Calculation of Booster SIP transfer amount on the date of the transfer of August 28, 20X1:

• Example if the latest EVI is 106, matrix defines a transfer of 0.10x of the base instalment amount. (10,000 *0.10), Rs. 1,000 will be transferred to the Target Fund B. Residual amount remains in Source Fund A

b. Calculation of Booster SIP transfer amount on the date of the transfer of September 28, 20X2:

• Example if the latest EVI is 92, matrix defines a transfer of 2.60x of the base instalment amount (10,000*2.60), Rs. 26,000 will be transferred to the Target Fund

B. Since there is residual Amount left in the Source scheme from earlier smaller transfers to the Target Fund B, Booster SIP transfers higher amounts when the market is attractive.

What will happen if source scheme does not have adequate balance?

In case the amount (as specified above) to be transferred is not available in the Source Scheme in the unit holder’s account, the residual amount will be transferred to the Target Scheme.

If the multiplier continues to be above 1X for a continuous period and the amount is not available in the Source Scheme, it will not utilize the full benefit of the multiplier and may transfer only SIP installment amount.

Can the target scheme change during the period?

No, the target scheme cannot be changed during the period. If someone wants to change the target scheme, they must cancel the existing Booster SIP and choose a new Booster SIP with a new target

What happens in case of redemption in the source scheme?

One can redeem from the source scheme if required. The Booster SIP will continue to transfer to the Target scheme as per the pre-determined interval if balance remains in the source scheme .

In case the debit does not take effect for five consecutive times then the Booster SIP registration would be liable for cancellation.

What happens in case of redemption in the target scheme?

One may redeem from the target scheme if required subject to exit load implications if any.

Is Booster SIP allowed for Minor investors?

Yes, however the registrations will done only till the date of Minor attaining Majority, even if the instructions may be for a period beyond that date.

Can an investor cancel the Booster SIP?

Unitholders can discontinue the facility by giving 30 days written notice to any of the Fund’s Investor Service Centres (ISCs) before next SIP date. Unitholders can discontinue the STP facility by giving 7(seven) working days written notice to any of the Fund’s Investor Service Centres (ISCs). Once registered, the facility cannot be modified. Investor may cancel an existing registration and register afresh under New separate form.

Can an investor pause the SIP?

Yes, Investor can pause the Booster SIP for a maximum period of three months.

Benefit of Booster SIP – ICICI Prudential

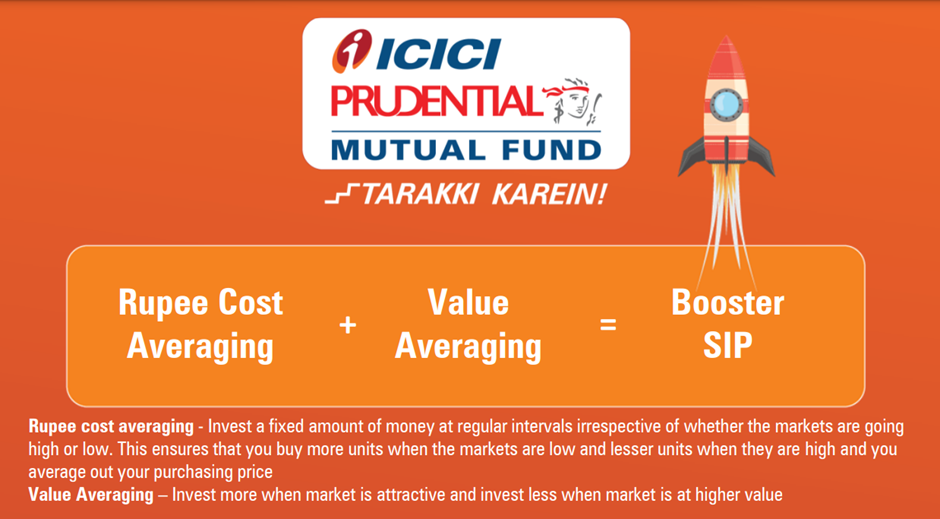

Only one spoon for rupee cost averaging and value averaging. We are all aware of the advantages of SIPs, such as the low investment amount and the flexibility to determine the period and amount of the investment. Another advantage is that money can be withdrawn at any moment. Even if a person withdraws the previous amount, the SIP will remain.

Rupee cost averaging: Because we acquire units every month, the cost of acquisition is averaged out, giving us rupee cost averaging. For example, Anil purchased one unit for Rs 10, another unit for Rs 11, a third unit for Rs 12, and a fourth unit for Rs 15. As a result, the net purchase price of one unit will be (10+11+12+15)/4 = 12 Rupees.

Value cost averaging : Because the SIP amount to target plan is further decided (a different amount is shifted depending on market conditions), the investment value is also averaged out here. In this case, one invests more in the low market and less in the high market. As a result, the value is also averaged. As a result, higher profits.

What is the difference between normal SIP & Booster SIP

There isn’t much of a difference. You will invest the same amount of money as if you were doing a simple SIP. However, the AMC’s role is different in this case. According to the EVI, the AMC would transfer the funds to the target fund ( explained above). Ultimately one can generate better returns.