LIC has launched LIC Dhan Rekha policy ( Plan number 863) on the 13th of December. Dhan Rekha plan is guaranteed addition money back plan.

LIC’s Dhan Rekha is a Non-linked, Non-participating, Individual, Savings, Life Insurance Plan available with payment of Single Premium and Limited Premium Payment terms of 10 years, 15 years and 20 years.

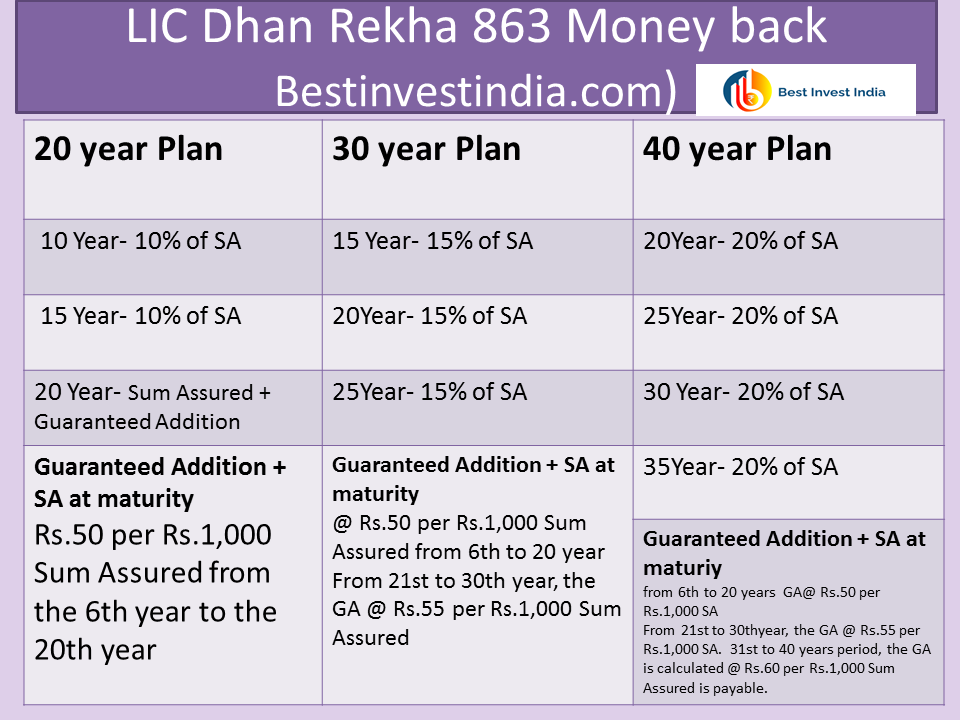

Under this plan, Survival Benefit as a percentage of Basic Sum Assured shall be payable during the Policy Term at regular intervals starting from the middle of the Policy Term.

This plan will also be available through online application process

Table of Contents

Features and Eligibility of LIC dhan Rekha 863

LIC Dhan rekha plan

Guaranteed Additions

LIC Dhan Rekha guaranteed addition

Maturity Benefit -Money Back – Dhan Rekha Plan

Money back Dhan rekha Plan

Death Benefit

Upon the sad demise of the life assured than 125% of sum assured is paid along with guaranteed addition.

Maturity/Death Benefit -Settlement option

- Settlement Option (for Maturity Benefit): It is an option to receive Maturity Benefit in instalments over a period of 5 years instead of lump sum amount under an in-force as well as Paid-up policy ( if your policy is in force)

- Settlement Option (for Maturity Benefit): This is an option to receive Death Benefit in instalments over the chosen period of 5 years instead of lump sum amount under an in-force as well as paid-up policy.

How to buy LIC Dhan Rekha Online

Login to LIC’s website https://www.licindia.in/ and click “BUY POLICY ONLINE”

→ Select “LIC’s Dhan Rekha” and click on “CLICK TO BUY ONLINE”

→ Fill contact details i.e. Name, Date of birth, mobile no, email ID and nearest City to create access id and OTP.

→ Enter captcha and submit. You will receive a 9 digit access id and OTP on your mobile no and email.

→ Enter OTP and proceed further.

→ Give sum assured and term to calculate premium, click in radio button yes and proceed for filling the form.

→ After successful submission of proposal, confirm the details and proceed for payment.

→ You can pay premium by Net banking/credit card etc.

→ After payment you will get introductory mail.

→ Non-medical cases will completed based on submitted documents.

→ For medical Service provider (MSP) will contact you. After medical, LIC will underwrite the case.

→ After getting the decision LIC will allot the policy number and will send details on your registered email ID.

→ Copy of Policy will be sent to you by mail as well by post.

→ Further servicing of your policy will be done in the servicing branch as per city selected by you.

Should you invest in LIC Dhan Rekha Plan?

The return from this plan is quite low as compared to premium paid and time invested. Therefore it is better to stay away from such plans. However if you are happy with the low returns and ready to take guaranteedmoney back and life cover than you can definitely go ahead with the plan.