LIC One time Investment Plan is a single premium endowment plan which provides life coverage and savings in one plan only. Just deposit one time single initial payment and enjoy life cover and maturity benefit.

Table of Contents

LIC’s SINGLE PREMIUM ENDOWMENT PLAN ( 917) – Eligibility & features

LIC single premium Endowment Plan is a traditional insurance plan. Like other Endowment Plans, this single premium plan also provide Guaranteed payment either on maturity or at time of unfortunate death during policy tenure.

| Minimum Sum Assured | Rs.50,000/- |

| Maximum Sum Assured | No limit |

| Minimum Policy Term | 10 years |

| Maximum Policy Term | 25 years |

| Premium Paying Term | Single Premium |

| Minimum Age at entry | 90 days (completed) |

| Maximum Age at entry | 65 years (Nearest Birthday) |

| Minimum Maturity Age | 18 years (completed) |

| Maximum Maturity Age | 75 years (Nearest birthday) |

| Mode of installment premium payment | Single premium |

Benefits under LIC Single Premium Endowment Policy ( 917)

Maturity Benefit

On maturity basic Sum Assured along with vested Simple Reversionary Bonuses and Final Additional Bonus (if any), is paid.

The life-insurance coverage will get terminated automatically after maturity date.

Death benefit

On death during the policy term BEFORE commencement of risk

single premium is returned back (excluding taxes, extra premium and rider premiums if any), without interest.

On Death during the policy term

Higher of the below two is paid along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any.

- Basic Sum Assured on death and

- 125% of single premium paid

Date of Commencement of risk: In case the age of Life Assured at entry is less than 8 years, risk coverage will start either 2 years from the date of commencement or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately.

For instance, Suppose Bestii Singh aged 5 years, is life assured buy LIC single Premium Endowment plan on 30/1/2023.

Since age is less than 8 years. The risk coverage will start after 30/1/2025 or at the age of 8 years. Here, time period of 2 years is completing in 2025 i.e. at the age of 7.

So, risk coverage will start from age 7 years only.

Settlement Option ( for Maturity/death)

Under LIC settlement option, one can take maturity benefit or death claim in instalments over a period of 5 years instead of lump sum amount. This option can be exercised for in force or paid policies.

| Mode of Instalment payment | Minimum Instalment amount |

| Monthly | Rs. 5,000/- |

| Quarterly | Rs. 15,000/- |

| Half-Yearly | Rs. 25,000/- |

| Yearly | Rs. 50,000/- |

Settlement Option( Death Claim)

One can choose to receive death benefit in instalments over the chosen period of 5 years instead of lump sum amount.

The instalments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum instalment amount for in force or paid policies.

Please refer above table.

Riders

The policyholder has an option of availing following Rider benefit(s):

- LIC’s Accidental Death and Disability Benefit Rider –In case of Accident death – the Accident Benefit Sum Assured will be payable in lump sum along with the death benefit under the base plan. In case of accidental disability arising due to accident (within 180 days from the date of accident), an amount equal to the Accident Benefit Sum Assured will be paid in equal monthly instalments spread over 10 years and future premiums to the extent of rider sum assure will be waived off.

- LIC new Term Insurance Rider – Opting this rider one can enhance life coverage by the rider amount. For example if the policy coverage is 5 lac and life assured buy 5 lac rider, than in case of death the nominee will get 10 lac instead of 5 lac.

Rider sum assured cannot exceed the Basic Sum Assured.

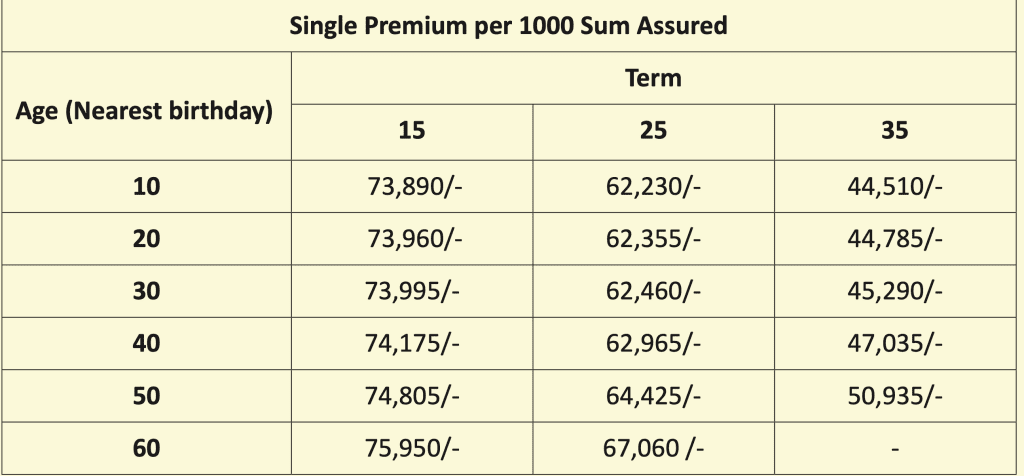

LIC One time Investment Plan ( 917)-Premium Chart

The sample illustrative premiums for Basic Sum Assured of Rs. 1 Lakh for Non-Smoker, Standard lives under Single Premium Payment options for Offline sales are as under:

LIC Single premium Endowment Plan- Should you buy?

LIC Single premium Endowment Plan is a saving cum insurance Plan. This is a good plan for risk averse investors who are happy with FD kind of returns from their investments. So the assured will get sum assured and bonus and FAB at the maturity time.

But before investing, it is better to explore other Pure investment and pure risk coverage Options too.

other LIC plans

Read more –LIC New tech term plan