Table of Contents

Which LIC Term Plan is better?

( LIC Tech Term Vs Jeevan Amar)

| Currently, LIC is offering two-term insurance plans. In this post, we will

compare the plans and know which LIC Term Plan is better.

# LIC Jeevan Amar & LIC Tech Term plan are pure insurance cover plan or pure Term plan. Both of LIC Term plan provides financial protection to your family in case of any unfortunate event with the life insured. #These plans are not linked to the market so there is no need to worry about market fluctuation for this plan. #LIC Tech Term plan is available only for online users and thus you cannot buy LIC Tech term through an agent while LIC Jeevan Amar Plan is available through advisors only. Both plans offer a lot of flexibility, features, and options to its users. |

You can opt from the two options of

life covers :

- Level Sum Assured– The sum assured remains the same throughout

- the term of the policy.

- Increasing Sum Assured – The sum assured increases with time i.e.

- after completion of 5 years.

You can also choose the policy term and premium paying term.

You can choose the different premium paying term.

The option of payment are in the form of

· Single premium

· Regular premium and

· Limited premium payment ( The cover is for long-duration but you pay

only for a few years)

- There is a special rate for women also.

- You also get high coverage premium reduction.

In case of unfortunate event what

the family will get/ Death Claim

( LIC Tech Term Vs Jeevan Amar)

The nominee will get the sum assured on the death of the policyholder.

Level Sum Assured – the nominee will get the basic sum assured which

remains the same throughout the policy term

Increasing Sum Assured- The basic sum assured will be paid on death

till 5th policy year and thereafter the sum assured is increased by 10%

every year till 15th policy year and it becomes double of basic sum

assured.

After completion of 15th year and onwards the double sum assured

remain constant till policy ends.

Caution: The death benefit option cannot be changed later.

There is no maturity benefit once the policy term ends

Riders

If you want to increase your risk cover than you can buy riders at a very

nominal cost.

The policy riders are available such as accident benefit rider, Waiver

of premium rider, and other riders under regular premium and

Limited premium payment mode provided you have bought at least a five-year cover plan.

You can buy the rider Sum assure up to the basic sum assured only.

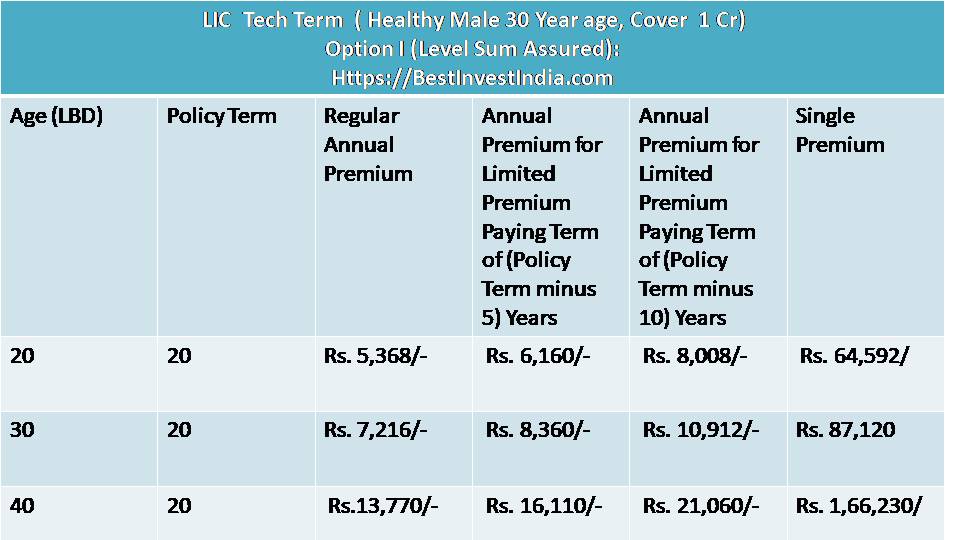

Premium Comparision

(LIC Tech TermPlanVs LIC Jeevan Amar)

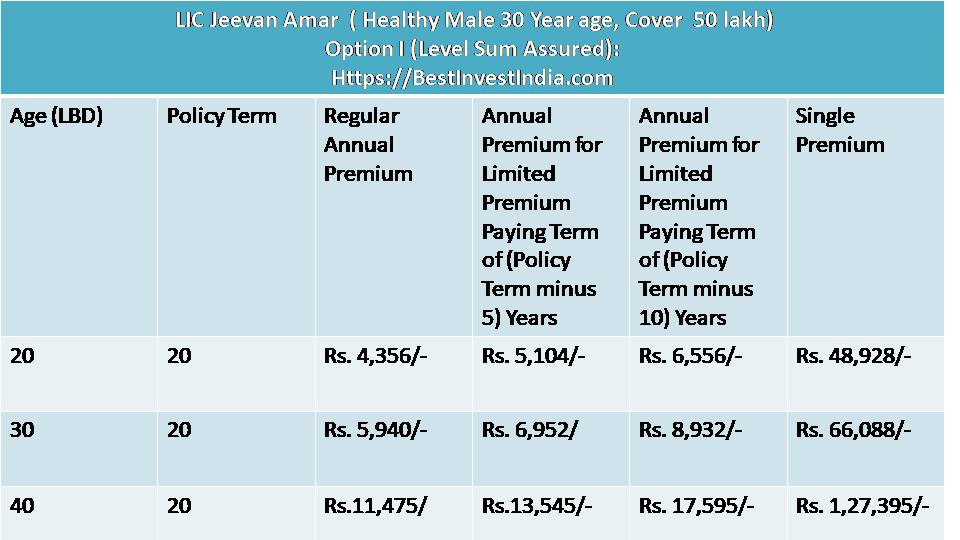

LIC Tech Term ( Healthy Male 30 Year age, Cover 1 Cr)

LIC Tech Term ( Healthy Male 30 Year age, Cover 1 Cr)

Option I (Level Sum Assured): 1 Cr

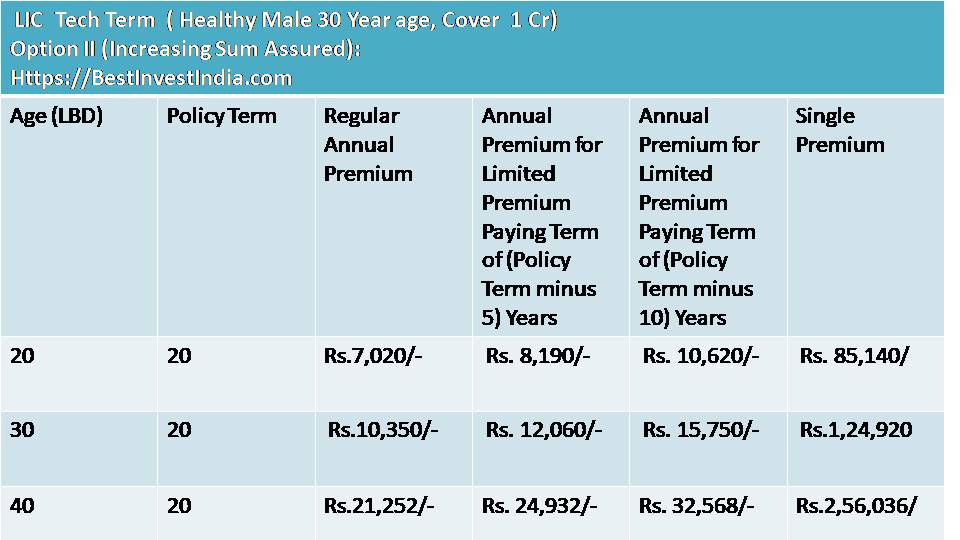

LIC Tech Term ( Healthy Male 30 Year age, 1 Cr)

Option II (Increasing Sum Assured):

Option II (Increasing Sum Assured):

Payout Option in case of a claim

( LIC Tech Term Vs Jeevan Amar)

The life assured can choose the option to receive death benefit installment

for the nominee.

The policyholder can choose the death claim payout option in his lifetime

only.

- Lump-sum amount

- The sum assured can be paid in installments in 5/10/15 or 20 years

- in absolute money terms or as % of sum assured

- You can also choose the payment interval as Yearly, half-yearly,

- quarterly or monthly interval

please note that this option can be exercised only by the policyholder and

not by the nominee.

Grace Period

30 Days Grace period is given for the payment of yearly or half-yearly

premiums from the date of the first unpaid premium.

Grace period applicable only for regular and Limited premium payment

During this period the policy will be considered in force with the risk cover.

If you do not pay the premium before the expiry of the grace days, your policy

will lapse.

What if you want to discontinue

the policy

If you want to discontinue the policy ( any of the plans) then there is no surrender value shall be available under the plan.

This means if you stop paying the premium you will not get anything in

return and your life cover will be discontinued.

Conclusion:

LIC has tried to give all varients as available with private life insurance companies. You can choose from options like Limited pay, regular pay, or a one-time payment.

Even you can choose premium payment frequency such as monthly,

quarterly, half-yearly, etc.

In the case of claim settlement, different options have been given.

Life assured can choose between a one-time lump sum payment or regular income for the nominee.

if you want to purchase a plan from LIC only then you can choose the term insurance plan LIC Tech Term plan if you are comfortable buying online. Otherwise, you can buy Jeevan Amar.

Additional Reading