Money investing is such a thing that everyone wants to play a safe game. But the need of the hour is to get good returns too. Not everyone is comfortable with market volatility and wants to know the safest investment with high returns.Here, in this post, we will explore the best safe investment options in India that offer capital protection and stable returns.

Table of Contents

Best Safe Investment Options in India

1. Fixed Deposit

Risk: Low

Lock-in: Flexible

Tax Status: Interest taxable

After saving bank account, the next best safe and easy investment option is a Bank Fixed Deposit.

Bank Fixed Deposits are an all-time favourite investment option for all age groups, whether you are a youngster, middle-aged, or a senior citizen. Banks and NBFCs offer fixed deposit with fixed interest rates. You can choose tenure and get assured returns at maturity.

Fixed Deposit is available for varied periods like 7 days/ 15 days/1 month/3 months/1 year or more years.

You can choose 5 year duration to get tax deduction U/S 80 C.

Why it’s safe: Backed by banks, and deposits up to Rs 5 lakh are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC)

2. Post Office NSC ( National Savings Certificate)

Risk: Very Low

Lock-in: 5 years

Tax Status: Interest taxable, Principal eligible under 80C

NSC is a 5 year one time deposit post office savings scheme backed by the Government of India.

Why it’s safe: Issued by the Government of India, making it a secure option.

Current rate of interest is 7.70%.

Just deposit a lump sum amount and purchase an NSC certificate.

At the end of the 5 years, submit the certificate and get the maturity amount (deposit amount plus Interest).

- A word of caution here – If you fail to withdraw after completion of 5 year than you will get saving bank interest rate till the time you withdraw money.

what is National Saving Certificate- Best one time deposit scheme

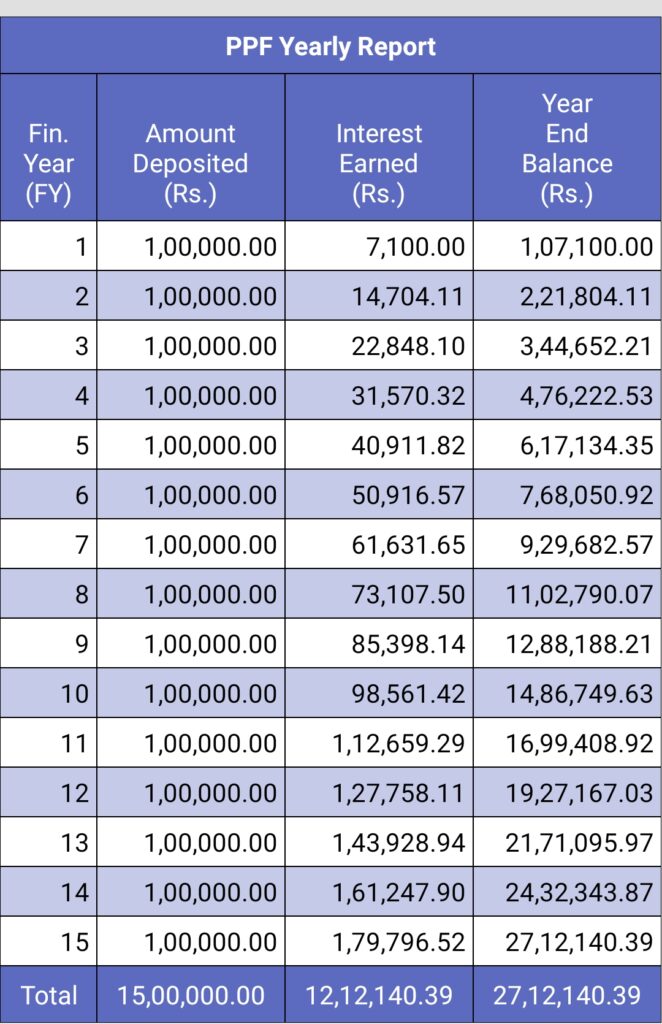

3. Public Provident Fund ( PPF )

Risk: Very Low

Lock-in: 15 years

Tax Status: EEE (Exempt-Exempt-Exempt)

PPF is a government-backed scheme ideal for long-term investors. It offers attractive interest rates, tax-free returns, and Section 80C benefits.

Public Provident Fund 15 year (yearly or any other mode contribution) is the best safe investment option in India. PPF is a great investment scheme for risk-averse investors.

Since PPF money can not be attached to a court decree, it makes it safer for investors with huge debts also.

Current rate of interest is 7.1%.

Why it’s safe: Sovereign guarantee by the Government of India makes it one of the safest investment options.

Moreover, the PPF account becomes a safe haven for senior citizens because of its tax-free withdrawals and guaranteed safe returns.

Any resident Indian can open PPF account for himself on behalf of a minor child or a person of unsound mind of whom he/she is a guardian.

read more about PPF withdrawal rules https://bestinvestindia.com/public-provident-fund-ppf-withdrawal-rules-2020/

4. Sukanya Samriddhi account

Risk: Very Low

Lock-in: 21 yrs

Tax Status: EEE

Sukanya Samriddhi Yojana is a government tax saving scheme which was launched as a part of Beti Bachao Beti padhao Yojana for the benefit of the girl child.

Current rate of interest is 8.2%.

Any Indian parents can open SSY account for the girl child.

- The account has a tenure of 21 years.

- You can open the Sukanya Samriddhi Yojana account if your girl child is below age 10.

- The SSY account matures after 21yrs.

- You have to deposit for 15 years from the date of opening of the account.

- The interest rate is 8.2% annually. The interest rate is revised from time to time.

- You can withdraw partially when the girl child attains age 18.

- The minimum investment is Rupees 250 and the maximum investment is Rupees 1.5 Lakh in a financial year.

- SSY Account Offers triple tax benefits.

- The principal amount invested get tax deduction U/S 80 C

- Interest earned is tax-free

- Maturity is also completely tax-free in nature

Sukanya Samriddhi Yojana( SSY) interest rate 2023-24

5. Post Office Monthly Income Scheme ( POMIS) :

Risk: Very Low

Lock-in: 5 years

Tax Status: Interest taxable

The five-year scheme offers a monthly payout or income to the subscriber.

Here, you have to deposit a lump sum amount, and thereafter you can take a monthly income for 5 years.

This is a low-risk fixed-income scheme that provides monthly interest payouts, perfect for retirees or those seeking regular income.

Why it’s safe: Operated by the India Post and backed by the government.

After completion of 5 years the the principal amount which you had initially deposit is given to you.

Post Office Monthly Income Scheme Interest Rate

6. Senior Citizen Saving Scheme

Risk: Very Low

Lock-in: 5 years

Tax Status: Interest taxable

Any Indian Citizen who is age 60 and above can purchase the scheme, deposit a lump sum amount and enjoy a quarterly safe income. You can withdraw deposited money prematurely with an imposed penalty.

Read more: Senior Citizen Saving Scheme (SCSS) Tax Benefit

7. RBI Floating Rate Bonds

Risk: Low

Lock-in: 7 years

Tax Status: Interest taxable, capital gains tax-free on maturity

The central GOI has replaced 7.75% bonds with RBI floating rate savings bonds 2020 ( Taxable) scheme. These bonds are available from July 1, 2020.

RBI Floating Rate Bonds are a government-backed, sovereign-guaranteed investment with a seven-year tenure. They offer a floating interest rate that resets semi-annually, 35 basis points above NSC interest rate.

The interest is paid on January 1 and July 1. These bonds are low-risk, non-transferable, and non-tradable, but offer a premature withdrawal facility for investors 60 years and older.

RBI Floating Rate Savings Bonds

What is the average return on a safe investment

The average return on safe investment varies from 5% to 8-9%.

Usually all safe investment option invest in debt instruments which typically give low return in this range only.

How to choose Best safe investment options in India

To choose best safe investment option in India you have to look in few factors such as

- investment duration

- Tax saving required or not

- You want to invest one time or regular

- When you need Money

- Do you need Liquidity in between

- Income tax slab rate

Final Thoughts

If your priority is capital safety over high returns, these options are ideal. They offer predictable returns, low risk, and peace of mind. A balanced approach can be:

- Keep your core money (emergency fund + near-term goals) in safe options

- Invest the surplus in growth-oriented instruments like equity mutual funds for long-term wealth creation